Arizona generated more tax revenue to the state general fund from legal marijuana sales than from tobacco and alcohol combined last month, state data released last week shows.

Tax deposits to the state general fund from medical and adult-use cannabis reached about $6.3 million in March, compared to $1.7 million from tobacco and $3.7 million from alcohol sales, according to the Arizona Joint Legislative Budget Committee (JLBC).

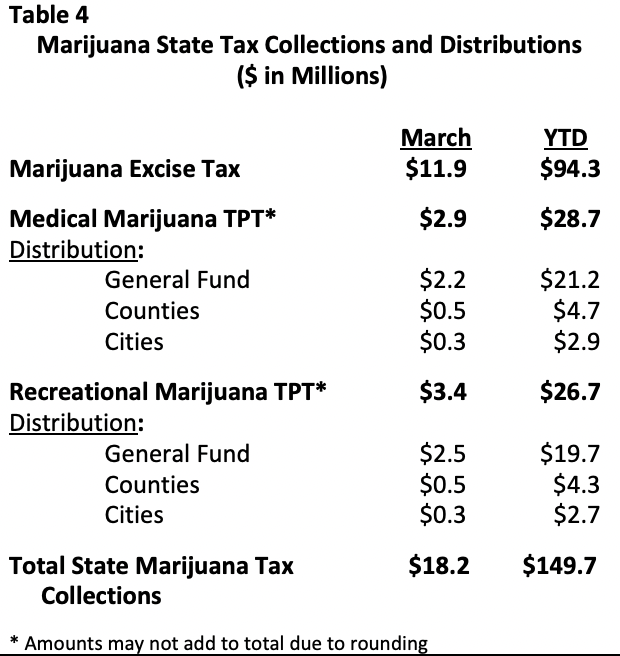

Beyond that $6.3 million in cannabis tax dollars for the general fund, marijuana excise taxes separately exceeded another $11.9 million last month, for a total of $18.2 million in marijuana revenue—most of which goes to the state, with smaller portions being distributed to cities and counties.

Advocates and stakeholders are touting the March figures. Not only do they underscore the economic opportunity of legalization, but the hope is that providing regulated access to cannabis means fewer people will use more dangerous drugs like alcohol and tobacco.

New JLBC numbers are out.

Tax revenue by industry in March:

Tobacco: $1.7m

Liquor: $3.7m

Cannabis: $6.3m

Happy 420, Arizona Taxpayers!

— Arizona Dispensaries Association (@az_dispensaries) April 20, 2022

To that end, alcohol tax revenue did fall short of the JLBC’s projections by $1.4 million, but the analysis

Read full article on Marijuana Moment