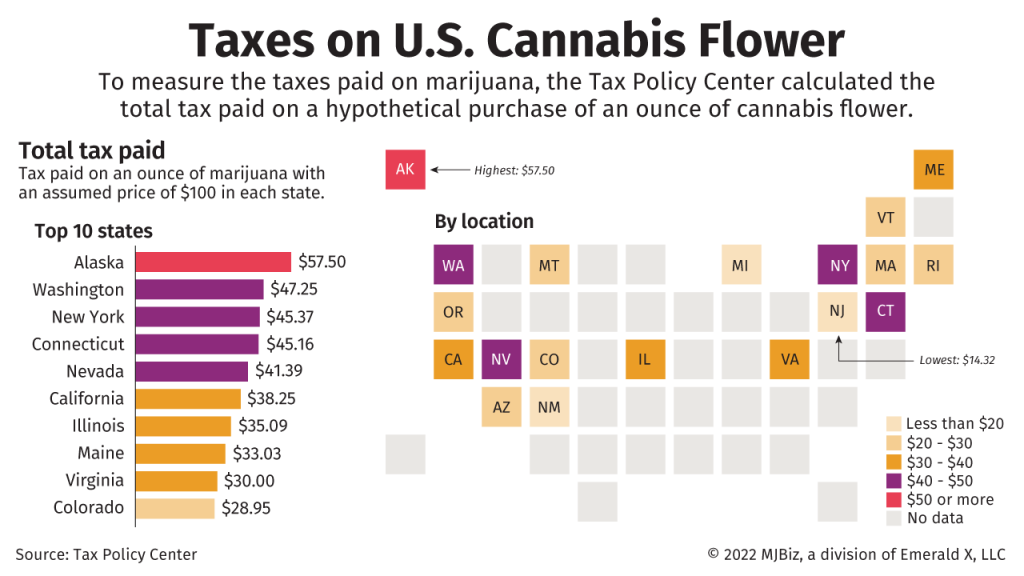

Alaska’s recreational marijuana taxes are the highest in the country, and New Jersey’s are the lowest.

That’s according to Richard Auxier and Nikhita Airi, the authors of the Urban-Brookings Tax Policy Center’s September report, “The Pros and Cons of Cannabis Taxes.”

ADVERTISEMENT

But it’s a tough comparison to make. No two states where adult-use marijuana is legal approach cannabis taxes the same way.

“Every state is a special and unique flower,” Auxier, senior policy analyst for the Tax Policy Center, told MJBizDaily.

From excise taxes to weight-based taxes to potency taxes to wholesale taxes and their respective rates, those discrepancies can make it difficult to compare adult-use marijuana taxes across the United States.

Such a patchwork can also complicate tax planning for cannabis businesses with aspirations to expand to multiple states.

That’s why Auxier and Research Analyst Nikhita Airi took a creative approach to examining marijuana taxes in

Read full article on Marijuana Business Daily