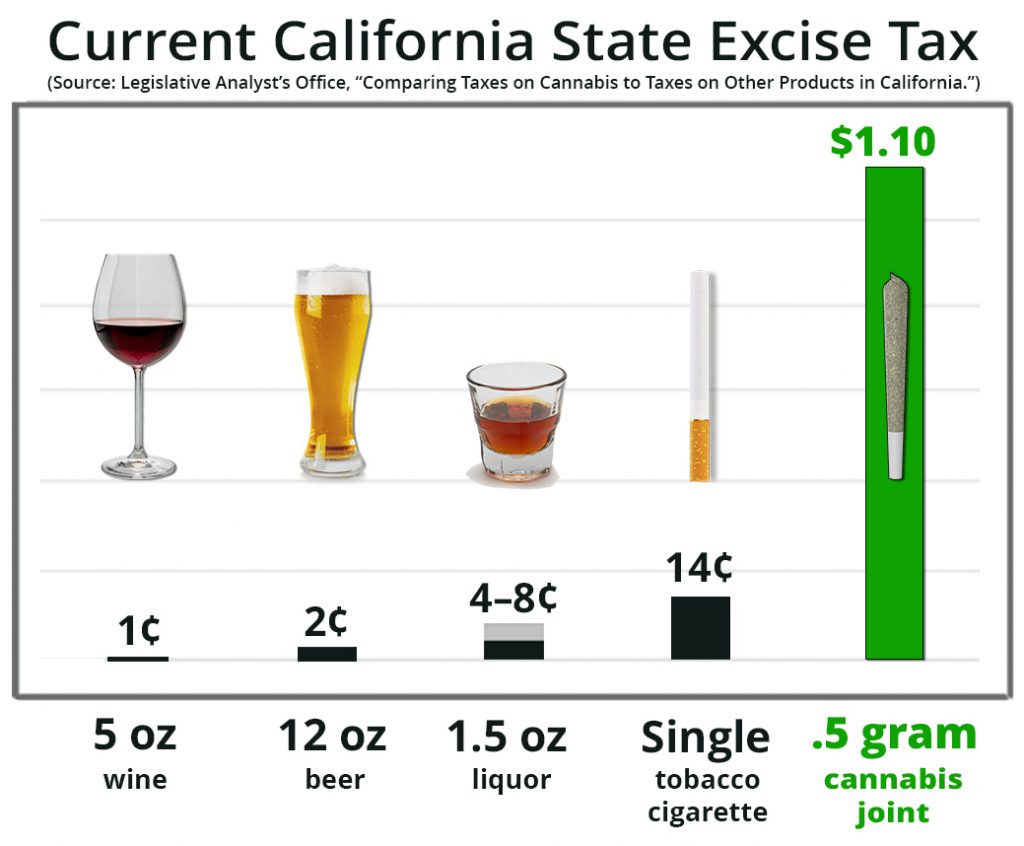

Whether you’re the kind of person who wants to End the Fed, or the kind of person who wants to tax the rich like a Scandinavian nation, you’ll probably agree on one thing: cannabis taxation is a problem. And it’s not just a small one. It’s theft. If I (or basically anyone else) had to pick one reason why the industry is in freefall, it’s taxation.

280E and the ultimate cannabis tax pitfall

Let’s start on the federal side. Section 280E of the Internal Revenue Code prevents a cannabis business from making almost any kind of deduction. A few years ago, the IRS clarified that cannabis businesses can deduct costs of goods sold. But that’s it. So cannabis businesses are ineligible for the vast majority of standard deductions available to businesses that sell alcohol, tobacco, opioids (so long as they’re legally prescribed of course), and a whole other slew of things that are objectively more harmful than cannabis.

It’s also worth noting that intoxicating hemp compounds aren’t subject to 280E, since hemp isn’t a controlled substance. Nor is the massive illegal market. Those businesses – which sell materially competitive products – pay less in taxes and can pass those savings

Read full article on HarrisBricken