Tax revenue from marijuana sales has gradually decreased in Colorado over the past five years as more states have enacted legalization and as intoxicating hemp products have grown in popularity, state officials say in a new report. Nonetheless, cannabis is still bringing in more tax dollars compared to alcohol or cigarettes.

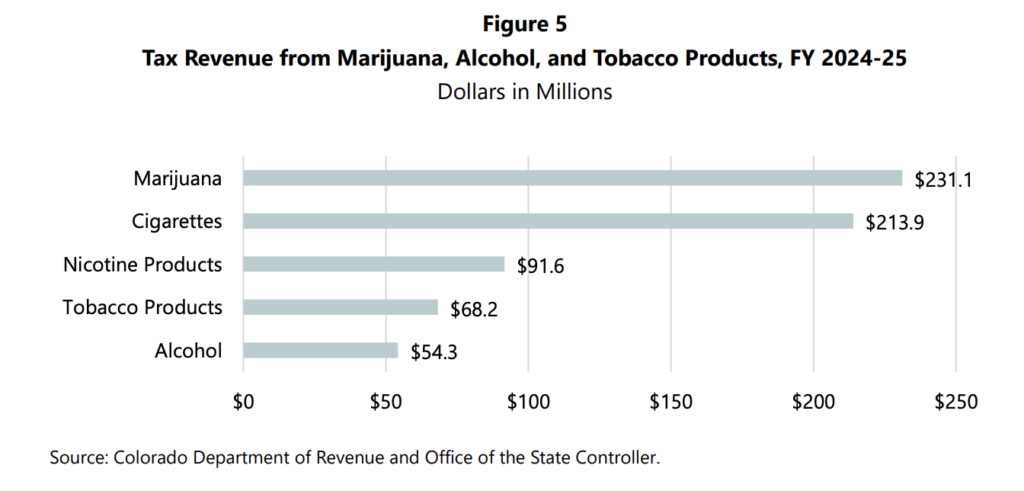

In a memorandum from the Colorado legislature’s nonpartisan Legislative Council, staff sought to answer “common questions about how revenue from the marijuana industry fits into Colorado’s state budget.” That includes the $231.1 million in cannabis revenue the state collected in the 2024-25 fiscal year.

Adult-use marijuana is taxed at three levels in Colorado: A 15 percent excise tax, 15 percent special sales tax and 2.9 percent state general sales tax. As one of the first states to legalize marijuana for recreational use, Colorado saw revenue from those sales grow “consistently for the first eight years of legalization, peaking at $424.4 million FY 2020-21.”

Following that, however, “revenue fell for the first time in FY 2021-22, and has declined each year since,” the Legislative Council said. “Marijuana tax revenue fell to $231.1 million in FY 2024-25, 45.5 percent below its FY 2020-21 peak.”

Notably, the memo says that the declining

Read full article on Marijuana Moment