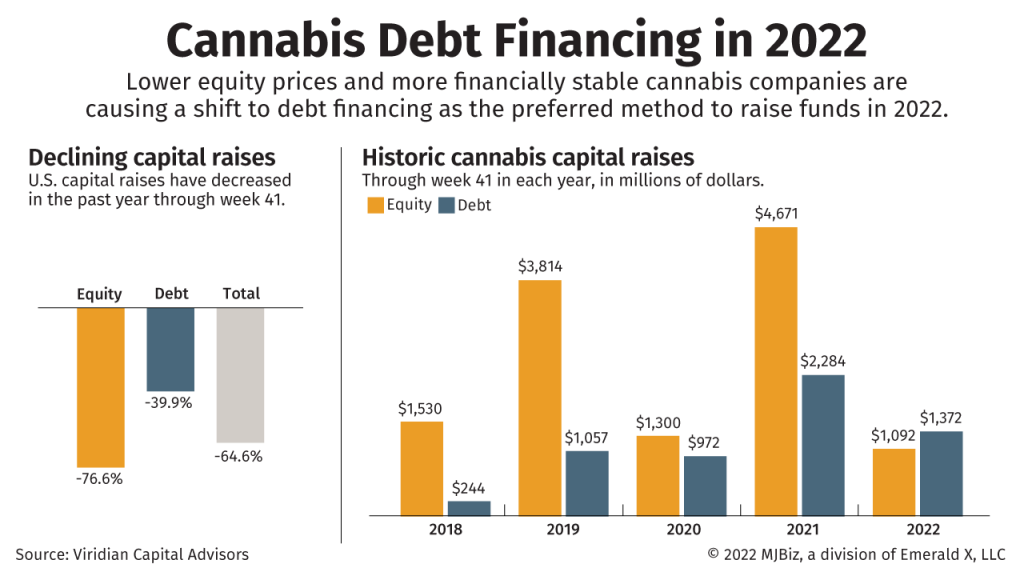

Capital raises in the U.S. marijuana industry are down nearly 65% this year versus 2021, but lower stock prices and more creditworthy cannabis companies mean debt financing is now the preferred method to raise funds for the first time in years.

Equity financing had dominated cannabis capital raises since at least 2018.

ADVERTISEMENT

But so far this year, debt funding has dominated, according to data collected by New York-based cannabis capital, M&A and strategic advisory firm Viridian Capital Advisors.

To be sure, debt financing in the U.S. marijuana industry is down by 39.9% compared to last year from January to October, according to Viridian data.

But year-to-date, debt now makes up 93% of capital raised by U.S. cultivation and retail companies and 55.7% in the U.S. industry overall.

The shift comes as more companies have spruced up their balance sheets and are better positioned to repay loans.

Looking ahead,

Read full article on Marijuana Business Daily