Since the U.S. Census Bureau first launched a map detailing the proportion of state revenue made up by marijuana tax money last fall, the agency has continued tracking the data, allowing further comparisons to be made over time.

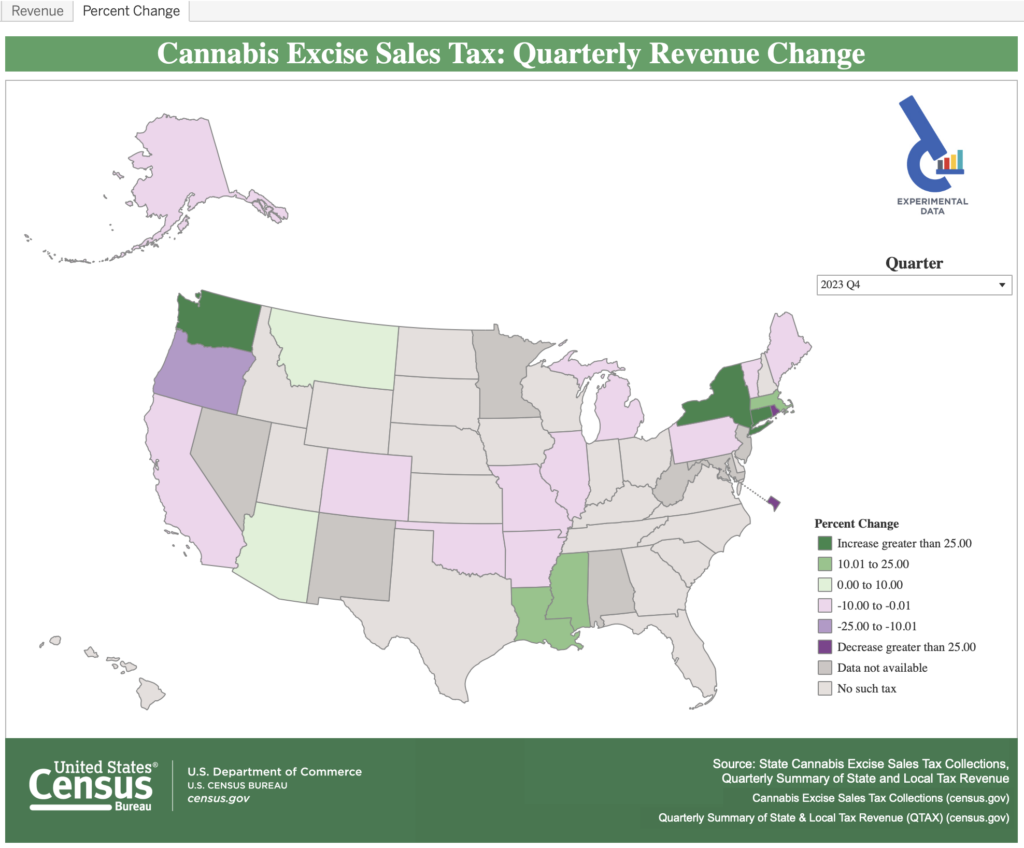

In the fourth quarter of 2023, for example, New York recorded about $14.8 million in excise tax on marijuana sales, making up a comparatively slim 0.02 percent of the state’s total tax revenue for the quarter. That’s an increase, however, of 49 percent compared to the preceding quarter—an indication of the potentially massive New York market still slowly getting off the ground after stores began opening there just over a year ago.

In Colorado, meanwhile—the first U.S. state to open retail cannabis stores to adults in 2014—marijuana tax revenue comprised 1.23 percent of all state tax revenue, at $61.0 million. That amounted to a 9.05 percent decrease from the previous quarter in the relatively mature marijuana market.

Recent standouts in terms of change include Connecticut, which saw more than a 150-percent increase in tax revenue between the most recent two quarters of available data, as well as Rhode Island and Washington, D.C. The latter two jurisdictions each saw excise tax receipts fall

Read full article on Marijuana Moment