Many marijuana companies seeking capital are expected to find limited pickings and costly terms this year, providing little relief from 2022, when the amount of money ponied up by investors tumbled more than 60% from the year before.

Still, investors are expected to open their checkbooks for certain types of businesses and opportunities.

ADVERTISEMENT

Analysts pointed to M&A deals aimed at scooping up distressed assets as well as ancillary businesses that often require less money to operate than plant-touching companies such as cultivators and retailers.

On the flip side, these same plant-touching businesses will likely face more obstacles raising capital, according to analysts.

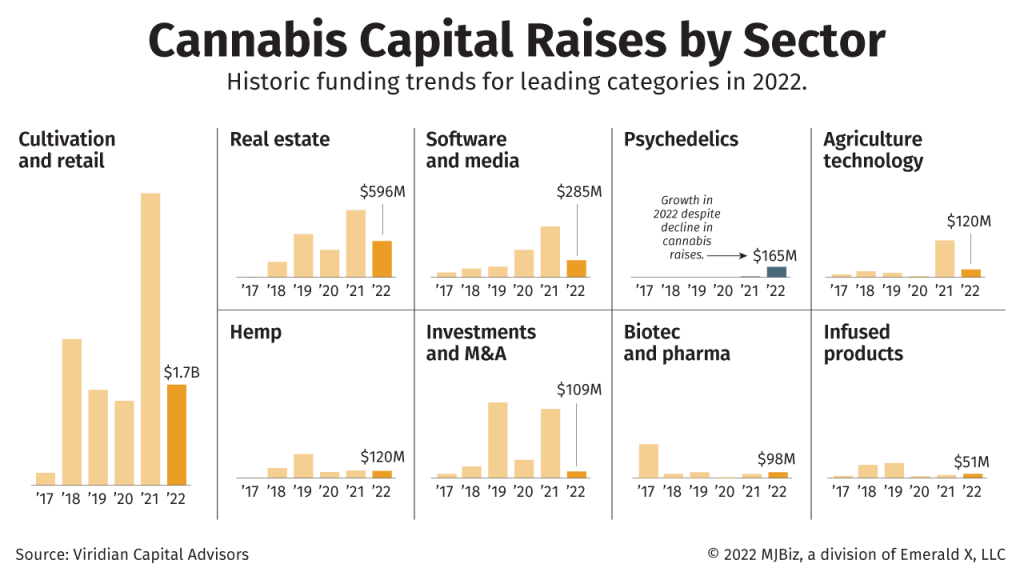

Last year, nearly every cannabis sector tracked by Viridian Capital Advisors – from M&A to cultivation to real estate – saw steep declines in capital raises compared to 2021’s capital markets boom, which was driven by sales growth, less expensive capital and hopes for

Read full article on Marijuana Business Daily