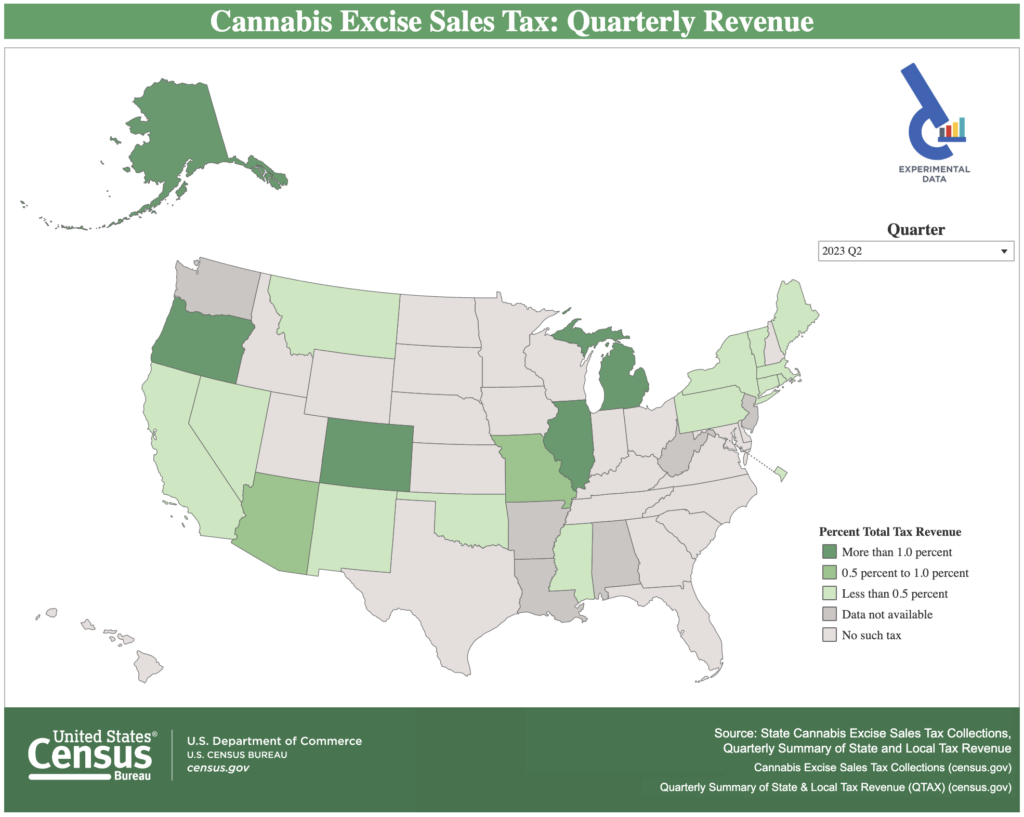

A new map published by the U.S. Census Bureau details the proportion of state revenue made up by marijuana tax money, and in some cases, the figures are eye-popping.

In Oregon, for example, roughly $1 in every $20 the state made during some recent time periods came from legal cannabis transactions. According to the federal data, marijuana taxes comprised 4.67 percent of Oregon’s total revenue in the first quarter of fiscal year 2023, 4.7 percent in the first quarter of 2022 and 5.21 percent in the third quarter of 2021.

While Oregon by far relied heaviest on marijuana tax dollars, other states—including Michigan, Illinois, Alaska and Colorado—consistently saw marijuana revenue make up at least 1 percent of state income over the past two years.

U.S. Census Bureau

The data covers the third quarter of fiscal year 2021 through the second quarter of the 2023 fiscal year, although the bureau has said that the sales data it reports for a given quarter typically reflects revenue that states collected on sales made during the prior quarter.

During the most recent quarter for which data is available, which accounts for sales through the end of December 2022, more than 3 percent of Oregon

Read full article on Marijuana Moment