After expenses, revenue can go towards processing cannabis expungements, supporting veterans, funding drug treatment and adding to the Missouri Public Defenders System’s budget.

By Rebecca Rivas, Missouri Independent

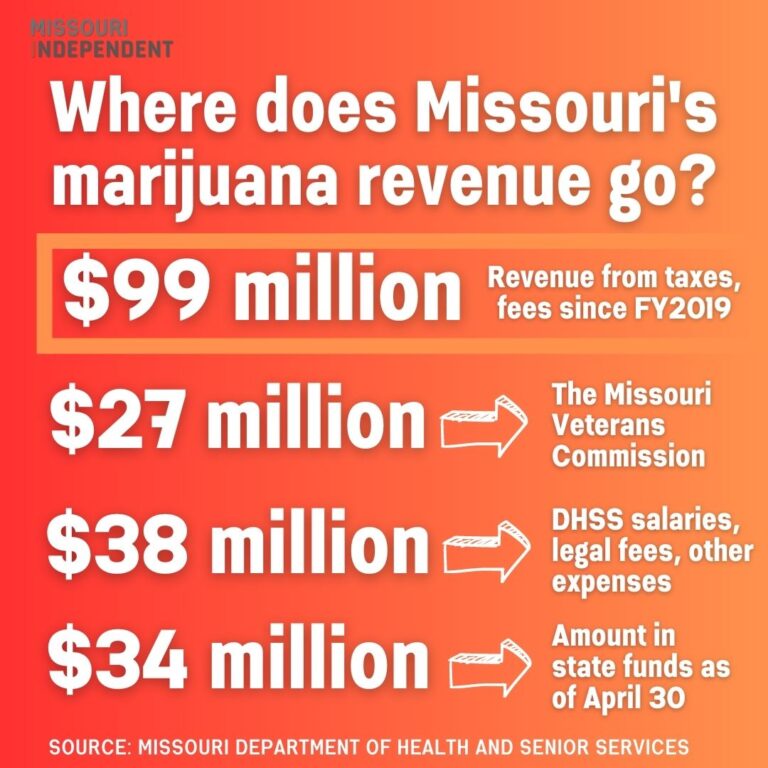

Since Missouri’s marijuana sales began in 2019, the state has collected nearly $100 million in revenue from taxes and program fees, according to state authorities.

Etched in the state’s constitution is a road map for where the revenue can go.

The first stop is operational costs. By law, any expense it takes to run both medical and recreational marijuana programs—like salaries or professional services—all must be paid for through marijuana revenues.

That means the salaries for cannabis inspectors will never compete with that of school teachers, which come out of the state’s main pot of money, the general revenue fund.

The agency that regulates the program, the Missouri Department of Health and Senior Services, told the Independent last week that their expenses have been $38.4 million to date.

Salaries for the department’s cannabis division make up about a third of that. Another third has gone towards hiring private attorneys to represent the state when companies appealed their application denials.

After expenses, the revenue can go towards supporting veterans, funding drug addiction treatment

Read full article on Marijuana Moment